Chapter: 7: COMPANY PROFILES

7.1. APPLE INC.

7.1.1. Company overview

7.1.2. Company snapshot

7.1.3. Operating business segments

7.1.4. Product portfolio

7.1.5. Business performance

7.1.6. Key strategic moves and developments

7.2. BROADCOM LIMITED

7.2.1. Company overview

7.2.2. Company snapshot

7.2.3. Operating business segments

7.2.4. Product portfolio

7.2.5. Business performance

7.2.6. Key strategic moves and developments

7.3. NXP SEMICONDUCTORS N.V. (FREESCALE SEMICONDUCTOR, LTD.)

7.3.1. Company overview

7.3.2. Company snapshot

7.3.3. Operating business segments

7.3.4. Product portfolio

7.3.5. Business performance

7.3.6. Key strategic moves and developments

7.4. INTEL CORPORATION

7.4.1. Company overview

7.4.2. Company snapshot

7.4.3. Operating business segments

7.4.4. Product portfolio

7.4.5. Business performance

7.4.6. Key strategic moves and developments

7.5. MEDIATEK INC.

7.5.1. Company overview

7.5.2. Company snapshot

7.5.3. Product portfolio

7.5.4. Business performance

7.5.5. Key strategic moves and developments

7.6. QUALCOMM INCORPORATED

7.6.1. Company overview

7.6.2. Company snapshot

7.6.3. Operating business segments

7.6.4. Product portfolio

7.6.5. Business performance

7.6.6. Key strategic moves and developments

7.7. SAMSUNG ELECTRONICS CO. LTD.

7.7.1. Company overview

7.7.2. Company snapshot

7.7.3. Operating business segments

7.7.4. Product portfolio

7.7.5. Business performance

7.7.6. Key strategic moves and developments

7.8. STMICROELECTRONICS N.V.

7.8.1. Company overview

7.8.2. Company snapshot

7.8.3. Operating business segments

7.8.4. Product portfolio

7.8.5. Business performance

7.8.6. Key strategic moves and developments

7.9. TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

7.9.1. Company overview

7.9.2. Company snapshot

7.9.3. Operating business segments

7.9.4. Product portfolio

7.9.5. Business performance

7.10. TOSHIBA CORPORATION

7.10.1. Company overview

7.10.2. Company snapshot

7.10.3. Operating business segments

7.10.4. Product portfolio

7.10.5. Business performance

LIST OF TABLES

TABLE 01. SYSTEM ON CHIP MARKET REVENUE FOR DIGITAL TYPE, BY REGION 2016-2023 ($MILLION)

TABLE 02. SYSTEM ON CHIP MARKET REVENUE FOR ANALOG TYPE, BY REGION 2016-2023 ($MILLION)

TABLE 03. SYSTEM ON CHIP MARKET REVENUE FOR MIXED SIGNAL TYPE, BY REGION 2016-2023 ($MILLION)

TABLE 04. SYSTEM ON CHIP MARKET REVENUE FOR CONSUMER ELECTRONICS APPLICATION, BY REGION 2016-2023 ($MILLION)

TABLE 05. SYSTEM ON CHIP MARKET REVENUE FOR TELECOMMUNICATION APPLICATION, BY REGION 2016-2023 ($MILLION)

TABLE 06. SYSTEM ON CHIP MARKET REVENUE FOR AUTOMOTIVE APPLICATION, BY REGION 2016-2023 ($MILLION)

TABLE 07. NORTH AMERICAN SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 08. NORTH AMERICAN SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 09. U.S. SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 10. U.S. SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 11. CANADA SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 12. CANADA SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 13. MEXICO SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 14. MEXICO SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 15. EUROPEAN SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 16. EUROPEAN SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 17. UK SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 18. UK SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 19. GERMANY SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 20. GERMANY SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 21. FRANCE SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 22. FRANCE SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 23. REST OF EUROPE SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 24. REST OF EUROPE SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 25. ASIA-PACIFIC SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 26. ASIA-PACIFIC SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 27. CHINA SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 28. CHINA SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 29. JAPAN SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 30. JAPAN SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 31. INDIA SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 32. INDIA SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 33. AUSTRALIA SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 34. AUSTRALIA SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 35. REST OF ASIA-PACIFIC SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 36. REST OF ASIA-PACIFIC SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 37. LAMEA SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 38. LAMEA SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 39. LATIN AMERICA SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 40. LATIN AMERICA SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 41. MIDDLE EAST SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 42. MIDDLE EAST SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 43. AFRICA SYSTEM ON CHIP MARKET, BY TYPE 2016-2023 ($BILLION)

TABLE 44. AFRICA SYSTEM ON CHIP MARKET, BY APPLICATION 2016-2023 ($BILLION)

TABLE 45. APPLE: COMPANY SNAPSHOT

TABLE 46. APPLE: OPERATING SEGMENTS

TABLE 47. APPLE: PRODUCT PORTFOLIO

TABLE 48. BROADCOM: COMPANY SNAPSHOT

TABLE 49. BROADCOM: OPERATING SEGMENTS

TABLE 50. BROADCOM: PRODUCT PORTFOLIO

TABLE 51. NXP: COMPANY SNAPSHOT

TABLE 52. NXP: OPERATING SEGMENTS

TABLE 53. NXP: PRODUCT PORTFOLIO

TABLE 54. INTEL: COMPANY SNAPSHOT

TABLE 55. INTEL: OPERATING SEGMENTS

TABLE 56. INTEL: PRODUCT PORTFOLIO

TABLE 57. MEDIATEK: COMPANY SNAPSHOT

TABLE 58. MEDIATEK: PRODUCT PORTFOLIO

TABLE 59. QUALCOMM: COMPANY SNAPSHOT

TABLE 60. QUALCOMM: OPERATING SEGMENTS

TABLE 61. QUALCOMM: PRODUCT PORTFOLIO

TABLE 62. SAMSUNG: COMPANY SNAPSHOT

TABLE 63. SAMSUNG: OPERATING SEGMENTS

TABLE 64. SAMSUNG: PRODUCT PORTFOLIO

TABLE 65. STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 66. STMICROELECTRONICS: OPERATING SEGMENTS

TABLE 67. STMICROELECTRONICS: PRODUCT PORTFOLIO

TABLE 68. TSMC: COMPANY SNAPSHOT

TABLE 69. TSMC: OPERATING SEGMENTS

TABLE 70. TSMC: PRODUCT PORTFOLIO

TABLE 71. TOSHIBA: COMPANY SNAPSHOT

TABLE 72. TOSHIBA: OPERATING SEGMENTS

TABLE 73. TOSHIBA: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01. KEY MARKET SEGMENTS

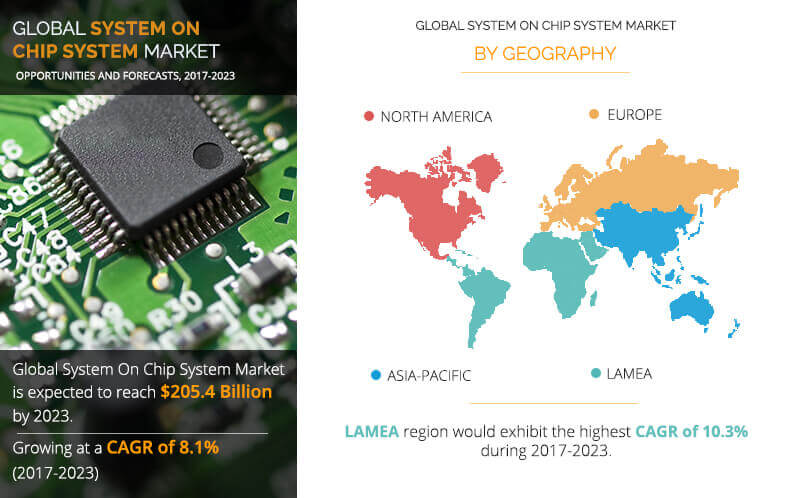

FIGURE 02. EXECUTIVE SUMMARY

FIGURE 03. EXECUTIVE SUMMARY

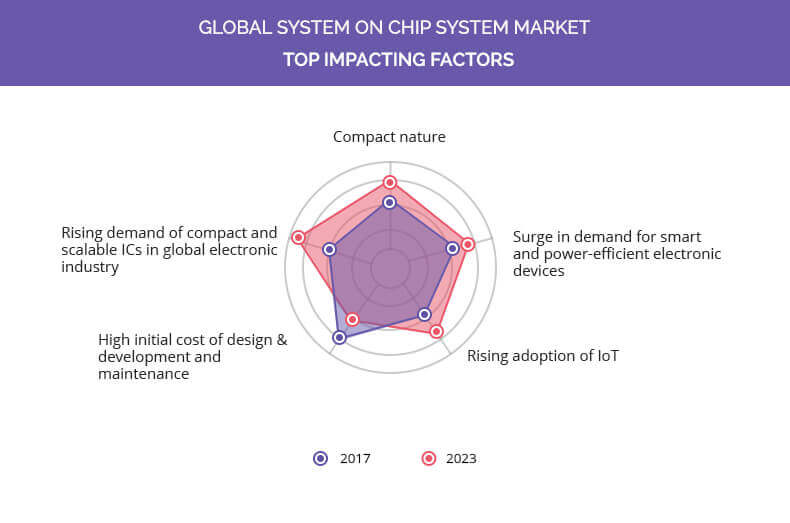

FIGURE 04. TOP IMPACTING FACTORS

FIGURE 05. TOP INVESTMENT POCKETS

FIGURE 06. MARKET PLAYER POSITIONING

FIGURE 07. GLOBAL SYSTEM ON CHIP MARKET, BY TYPE, 2016-2023

FIGURE 08. COMPARATIVE SHARE ANALYSIS OF DIGITAL SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 09. COMPARATIVE SHARE ANALYSIS OF ANALOG SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 10. COMPARATIVE SHARE ANALYSIS OF MIXED SIGNAL SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 11. GLOBAL SYSTEM ON CHIP MARKET, BY APPLICATION, 2016-2023

FIGURE 12. COMPARATIVE SHARE ANALYSIS OF CONSUMER ELECTRONICS APPLICATION ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 13. COMPARATIVE SHARE ANALYSIS OF TELECOMMUNICATION SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 14. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 15. SYSTEM ON CHIP MARKET, BY REGION, 2016-2023 (%)

FIGURE 16. COMPARATIVE SHARE ANALYSIS OF SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 17. U.S. SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 18. CANADA SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 19. MEXICO SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 20. COMPARATIVE SHARE ANALYSIS OF SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 21. UK SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 22. GERMANY SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 23. FRANCE SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 24. REST OF EUROPE SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 25. COMPARATIVE SHARE ANALYSIS OF SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 26. CHINA SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 27. JAPAN SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 28. INDIA SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 29. AUSTRALIA SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 30. REST OF ASIA-PACIFIC SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 31. COMPARATIVE SHARE ANALYSIS OF SYSTEM ON CHIP MARKET, BY COUNTRY, 2016 & 2023 (%)

FIGURE 32. LATIN AMERICA SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 33. MIDDLE EAST SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 34. AFRICA SYSTEM ON CHIP MARKET, 2016-2023($BILLION)

FIGURE 35. APPLE: NET SALES, 2015-2017 ($MILLION)

FIGURE 36. APPLE: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 37. APPLE: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 38. BROADCOM: NET SALES, 2015-2017 ($MILLION)

FIGURE 39. BROADCOM: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 40. BROADCOM: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 41. NXP: NET SALES, 2014-2016 ($MILLION)

FIGURE 42. NXP: REVENUE SHARE BY SEGMENT, 2016 (%)

FIGURE 43. NXP: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 44. INTEL: NET SALES, 2014-2016 ($MILLION)

FIGURE 45. INTEL: REVENUE SHARE BY SEGMENT, 2016 (%)

FIGURE 46. INTEL: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 47. MEDIATEK: NET SALES, 2014-2016 ($MILLION)

FIGURE 48. MEDIATEK: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 49. QUALCOMM: NET SALES, 2015-2017 ($MILLION)

FIGURE 50. QUALCOMM: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 51. SAMSUNG: NET SALES, 2014-2016 ($MILLION)

FIGURE 52. SAMSUNG: REVENUE SHARE BY SEGMENT, 2016 (%)

FIGURE 53. SAMSUNG: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 54. STMICROELECTRONICS: NET SALES, 2014-2016 ($MILLION)

FIGURE 55. STMICROELECTRONICS: REVENUE SHARE BY SEGMENT, 2016 (%)

FIGURE 56. STMICROELECTRONICS: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 57. TSMC: NET SALES, 2014-2016 ($MILLION)

FIGURE 58. TSMC: REVENUE SHARE BY GEOGRAPHY, 2016 (%)

FIGURE 59. TOSHIBA: NET SALES, 2015-2017 ($MILLION)

FIGURE 60. TOSHIBA: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 61. TOSHIBA: REVENUE SHARE BY GEOGRAPHY, 2017 (%)